What is FinGenius?

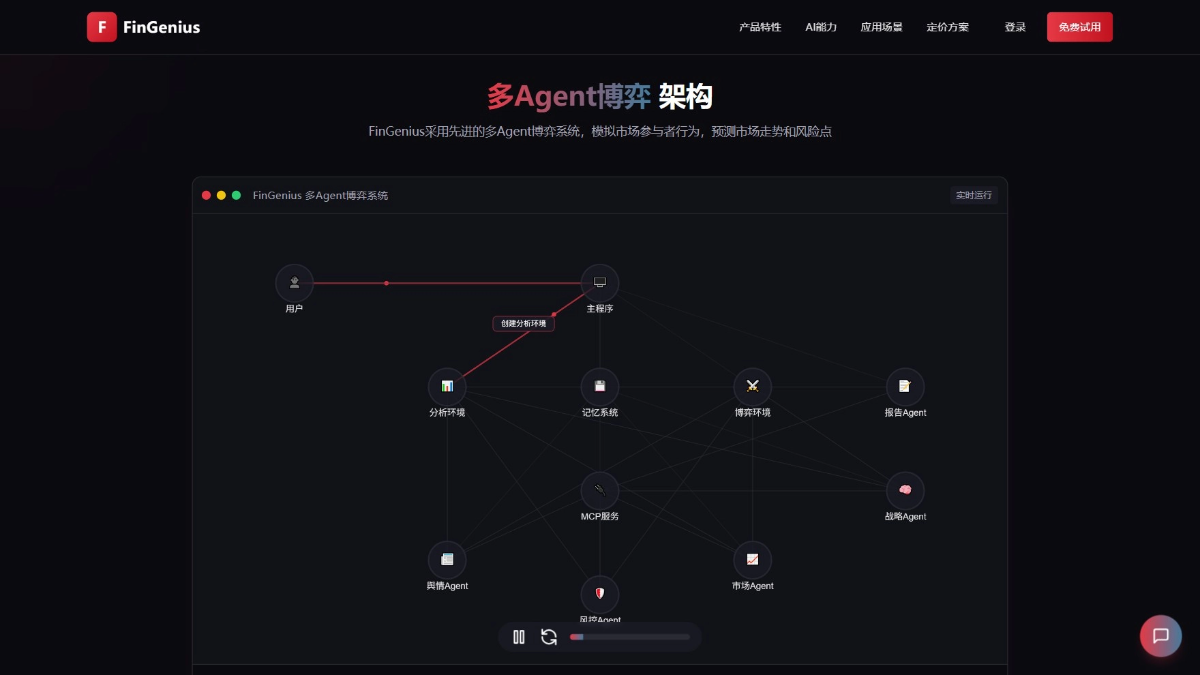

FinGenius is an innovative A-share AI financial analysis tool based on a multi-intelligence game architecture that simulates the behavior of market participants.FinGenius quickly generates accurate financial analysis reports through the collaboration of 16 superintelligences (e.g., public opinion, lobbying, risk control, etc.).FinGenius optimizes decision-making through the introduction of game theory, and provides personalized analysis by combining with the "Yearly Memory Rule Algorithm" to record users' investment habits. FinGenius introduces game theory to optimize decision-making, combines with the "Yearly Memory Rule Algorithm" to record users' investment habits and provide personalized analysis. FinGenius supports real-time data processing, monitors market anomalies in milliseconds, identifies potential risks in advance, and generates structured and multimodal reports to help investors and financial institutions to improve their decision-making efficiency and reshape the way they analyze finance, making it an intelligent assistant in the field of finance.

Main Features of FinGenius

- Multi-Intelligence Collaborative Analysis: With the help of multiple professional intelligences (e.g., public opinion, lobbying, risk control, etc.), we conduct in-depth analysis of market data from different perspectives, simulate the interaction of market participants, optimize the decision-making process, and predict the market trend.

- Deep data integration and report generation: Integrate multiple data sources to quickly distill key information and risk points and generate structured multimodal reports.

- Real-time data processing: Millisecond speed processing of massive financial data, real-time monitoring of market anomalies and early identification of potential risks.

- Risk Early Warning System: Monitor market dynamics in real time, identify potential risks in advance, and provide security for financial analysis.

- MCP Intelligent Calling and Tool Integration: Based on Model Context Protocol (MCP), it enables seamless collaboration between models and supports a plug-and-play ecosystem of financial instruments.

FinGenius's official website address

- Official website address:: http://fingenius.cn/

- GitHub repository:: https://github.com/HuaYaoAI/FinGenius

How to use FinGenius

- Register Login: Visit the FinGenius website or download the mobile app (found on Honor, Xiaomi, Vivo and other app markets), create an account and log in.

- Start analysisWe use multi-intelligence analytics to simulate market behavior and obtain market trends and risk points; we use MCP functions to achieve model collaboration and financial data analysis; and we rely on risk warning systems to monitor market anomalies.

- Customized Settings: Set up analysis parameters and warning conditions, such as stocks to watch, risk thresholds, etc., according to your personal investment habits and preferences.

- monitoring and analyzing: Regularly review the analytics and alerts provided by FinGenius to make investment decisions based on your own judgment.

- Advanced operations (optional): For a more in-depth look, refer to the FinGenius GitHub project, follow the installation guide (using conda or uv install) for local deployment, create a configuration file and add customizations such as API keys, run FinGenius and use the command line to specify the output format, save the results, and so on.

Product Advantages of FinGenius

- Multi-Intelligence Collaboration: By simulating the behavior of market participants and using multiple professional intelligences (e.g., public opinion, lobbying, risk control, etc.) to divide the work and analyze the market data from different perspectives, it generates more comprehensive and accurate financial analysis reports.

- Game Theory Optimization Decision Making: Introducing game theory to optimize the decision-making process and simulate the complex interactions in the real market, helping users make more scientific and reasonable investment decisions in the complex financial market.

- personalized analysisThe "Yearly Memory Rule Algorithm" records users' investment habits and preferences and provides personalized financial analysis and investment advice to enhance the user experience.

- Real-time data processing and risk warning: Milliseconds to process massive financial data, real-time monitoring of market dynamics, identify potential risks in advance, provide investors with timely risk warning, to protect investment security.

- dual-environment architecture: Integrates the Research and Battle environments to simulate real-world research and decision-making processes, ensuring consistency of analysis and accuracy of decision-making.

- Seamless information flow and continuous status management: Achieve complete information transfer from research to decision-making, maintain continuity and contextual consistency of the analytical process, and safeguard the reliability of decision-making.

- Powerful tool integration: Based on Model Context Protocol (MCP), it supports seamless collaboration between models and a plug-and-play ecosystem of financial tools, making it easy for users to extend functionality according to their needs.

FinGenius application scenarios

FinGenius application scenarios include: investment decision support, providing comprehensive stock analysis and portfolio optimization recommendations to help investors make smarter investment decisions. Risk management, which monitors market anomalies in real time, identifies potential risk points in advance, and provides financial institutions with risk early warning and assessment to help them effectively avoid risks.TheMarket trend analysis, real-time market dynamics and industry trends, to help investors and institutions to grasp the direction of the market and develop appropriate investment strategies. Quantitative trading, providing quantitative trading signals and strategy optimization recommendations to help quantitative traders capture trading opportunities and improve trading efficiency and returns.TheInvestment research, providing in-depth data analysis and research support for investment researchers, helping investment decisions and improving research efficiency and quality.

Related Navigation

Free AI Agent from Knowledge Creation

Bobby.

RockFlow Launches Financial AI Agent

Chaos Deep Innovation

AI Native Strategy Consulting Agent

Dia

AI Native Browser Launched by Team Arc

Button Space

General purpose AI intelligences launched by ByteDance

Such an AI employee

Hosted AI Agent from Promotion-Customer Acquisition-Conversion-Private Domain Full Chain

01Agent

全能型AI图文创作智能体,支持多平台自动发布

Drafting AI Community

Drafting Launches One-Stop Design Agent and AI Creative Community

No comments...