Application Guide for Issuance of China Tax Resident Identity Card: Applicable to Google AdSense Tax Residency Certificate and Other Scenarios

Google AdSense Tax Information Management: How to Apply for Tax Residency Certificate/Chinese Tax Resident Identity Certificate

A comprehensive guide on how to apply for China Tax Residency Certificate for Google AdSense and other multinational income scenarios. Learn about the role of tax residency certificates, application process, required documents and FAQs to ensure compliance and enjoy tax benefits.

When individuals and businesses earn cross-border income through internet platforms, in order to ensure tax compliance and enjoy tax treaty benefits, many platforms (e.g. Google AdSense) require users to provide proof of tax residency, in particular the China Tax Resident Identity Card (中国税收居民份证明). In this article, we will introduce in detail what is Tax Residency Certificate, why you need to apply for it, how to apply for it, and related considerations. This article not only applies to Google AdSense users, but also applies to other scenarios that require proof of tax residency.

What is proof of tax residency?

Proof of residence for tax purposes (Tax Residence Certificate, TRC) is a document issued by the government to certify a taxpayer's residence for tax purposes. Its main purpose is to prevent tax fraud resulting from the incorrect application of international tax treaties.

For Chinese residents, proof of tax residency is the China Tax Resident Identity Card It is an official document issued by the Chinese tax authorities to certify the tax residency status of an individual or business in China.

Applicable Scenarios ::

- Google AdSense Users : Google requires users to provide proof of tax residency to determine the applicable withholding rate.

- Transnational investment or operations : Chinese residents are required to provide this certificate to enjoy tax benefits when they earn income in countries or regions with which China has entered into tax treaties.

- Other cross-border income scenarios : e.g. cross-border labor, copyright income, dividend distributions, etc.

Why do I need to apply for a tax residency certificate?

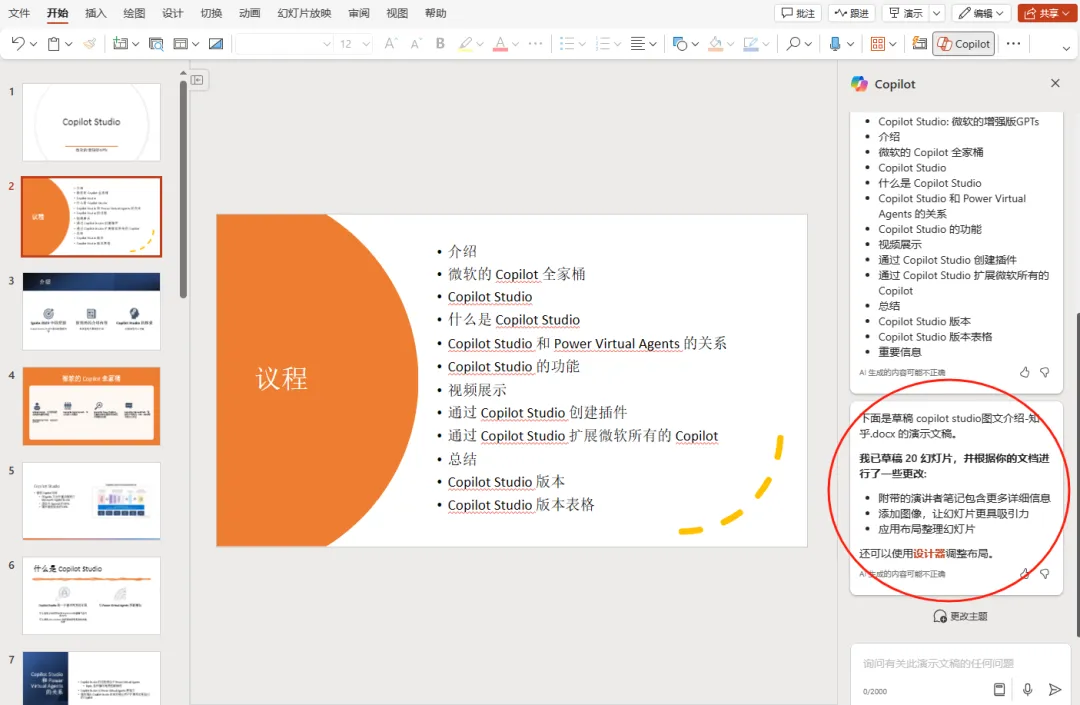

For Google AdSense users, you may receive a notification like the one below asking you to update your tax information:

Among other things, it is necessary to upload the Proof of Tax Residency in China. The need to upload proof of tax residency is generally because:

- Avoidance of double taxation : China has entered into tax agreements with several countries for the avoidance of double taxation. By providing a Certificate of China Tax Resident Status, you can prove that you are eligible for these agreements and thus avoid double taxation in your source country and in China.

- Reduced withholding tax rates : Without proof of tax residency, the income source country may withhold tax at the highest rate (e.g., 30%). When proof is provided, the withholding rate may be significantly reduced or even exempt.

- Compliance with the Platform's policy requirements : Many multinational platforms (e.g. Google AdSense) require users to submit tax information. Failure to update or submit proof in a timely manner may result in higher tax rates or account restrictions.

- Enjoyment of tax treaty benefits : Chinese residents can enjoy preferential treatment under tax treaties and reduce their tax burden by providing this certificate when they earn income outside China.

How to apply for the China Tax Resident Identity Card?

Prior to this, the China Tax Resident Identity Certificate could be applied online at the Shenzhen e-Tax Bureau website, but from the end of September 2024, this function disappeared from the e-Tax Bureau website. For more details, please read my previous tutorial on applying for Adsense Tax Residency Certificate: How to apply for China Tax Resident Identity Certificate.

summarized below Shenzhen subprovincial city in Guangdong, special economic zone close Hong Kong As an example, we will introduce in detail the online application process for the Certificate of China Tax Resident Status. The application process in other regions may be slightly different, but the overall steps should be similar. At present, the China Tax Resident Identification Card can still be applied for online, and the way to do so is through WeChat:Shenzhen Tax Service Carry out the processing.

Preparation before applying for the China Tax Resident Identity Card

Necessary materials prompted in the official processing interface of Shenzhen Tax Service Number (there may be more than these 3 items in the actual application, which will be explained in detail later):

- Application Form for Chinese Tax Resident Identity Card. DownloadableChina Tax Resident Identity Card Application FormFill in locally and upload, or fill in online The

- Contracts, agreements, resolutions of the board of directors or shareholders' meeting, payment vouchers and other supporting information related to the income to be treated under the tax treaty. It is possible to useChinese version of "AdSense Online Terms of Service" (click to download)Upload it as a PDF file The

- Instructions for Unable to Process in the Electronic Tax Office. You can take a screenshot of the Shenzhen e-Taxation Bureau website interface The

Screenshot of Shenzhen e-Taxation Bureau interface:

Materials 2 and 3 can be directly uploaded with the materials provided in this article. Material 3 do not download the template it provides, its template is damaged word document, simply can not open, with the above screen shot of the interface instead of the tax instructions say that there is no processing entrance can be. The main material 1 need to fill out this application form for China Tax Resident Identification.

[Emphasis added] All the materials actually required for the application of "China Tax Resident Identity Card".

After submitting the application for China Tax Resident Identity Card, it may be accepted by different tax offices, and each tax office may have different requirements for supporting documents, and some may need to sign or attach other information on the submitted documents, etc. I was the information was returned several times by different tax offices (tearful history), comprehensively organized, we had better need to prepare all the following materials:

- Fill in the application form of "China Tax Resident Identity Card", print it and sign it.

- Chinese version of Google AdSense

- Additional description and signature of the Google AdSense agreement (need to indicate that a regular contract is not available, only a service agreement)

- Upload the "Explanation of Unable to Process in E-Tax Bureau". In some areas (e.g. Shenzhen), the E-Tax Bureau has closed the online application portal, so you need to provide relevant instructions.

- Photo ID (front and back) required

- Provide a statement of habitual residence in Shenzhen due to domicile, family and economic interests and sign it

- Provide information that can prove that you live or work in Shenzhen (e.g. proof of tax payment, proof of social security, real estate license, housing rental contract, proof of residence, etc.)

This is all the files I ended up uploading:

The above mentioned template of the related document description document is placed in the appendix at the end of the article, which can be referred to if needed.

Steps to apply for the China Tax Resident Identity Card

It is highly recommended that you use the computerized version of the WeChat client on the following operations, it is quite inconvenient to mess with ...... on your phone!

1. Open WeChat, search for "Shenzhen Tax Service No." and click "I want to do". ::

2. After entering the list of frequently used functions of "I want to do", select "remote office", you need to log in with your real name, and select "natural person" for individuals. Business ::

3. Select "Business List" - "International Taxation" - "Issuance of China Tax Resident Identity Card". ::

There will be a pop-up window reminding you to go to the E-Tax Bureau to do it, but the E-Tax Bureau does not provide an entrance to do it, so choose "upload supporting evidence" and you will enter the data uploading interface, fill in the form and upload all the other materials mentioned above according to the requirements, and remember to upload the corresponding document description oh.

friendly reminder If you are operating on a cell phone or do not have a computer version of WeChat, you can just fill out the "tax instructions" and directly click "Save Draft", which will be synchronized to the tax bureau's web server, and then you can visit the tax office through theThis link.It's a lot easier to do it on the computer now.

Tax preparation instructions simply state the situation, for example:

申请中国税收居民身份证明。

谷歌AdSense税务信息管理要求上传中国税收居民身份证明。

无法在电子税务局办理说明:

上传的截图是为了说明电子税务局未提供申请中国税收居民身份证明的功能,

《无法在电子税务局办理说明》模板下载后无法打开,因此上传截图说明。

4. Completion of the application form for the China Tax Resident Identity Card ::

Here's what you need to know. How to fill in the application form for the Certificate of China Tax Resident Status , and some notes.

The main contents of the application form for the China Tax Resident Identity Card are as follows, all the required fields and fixed contents are listed for you:

- Applicant Information : Check the box "Individual"

- Basic Information ::

- Applicant Name: Enter your Chinese name

- English name: Pinyin (it doesn't matter whether the first name or the last name comes first)

- Correspondence address, domestic residence address, current residence address: it is recommended to fill in the real address.

- Contact phone number: fill in your cell phone number

- Name of competent tax authority: optional

- Information on applying for the issuance of a Tax Resident Certificate ::

- Year of application: current year

- Contracting Party: Republic of Singapore

- Name of counterparty (in English): Google Asia Pacific Pte. Ltd.

- Name of counterparty (in Chinese): Google Asia Pacific Pte Ltd.

- Counterparty Taxpayer Identification Number: 200817984R

- Name of Agreement to be Enjoyed: Agreement between the Government of the People's Republic of China and the Republic of Singapore for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income

- Terms of agreement to be enjoyed: independent individual labor

- Amount of income to be covered by the agreement: optional (confirmed by phone, no effect)

- Estimated amount of tax relief: fill in the amount according to (the amount of income to be entitled to the agreement x the percentage of relief), such as 10%, 20%, whatever, but not 100%, that is, the same as the amount of income to be entitled to the agreement (blood and tears, meet the strict examiners)

- To be completed when the applicant is an individual ::

- Nationality: People's Republic of China

- Occupation: your occupation

- ID information: type, number

- Residence information: check "Yes" and "No" for your actual situation. Current address must be filled in The

Also note that there are two duplicate forms related to the proposed agreement in the application form, so fill them all out with the same information; if you don't, they may be returned to you for re-filling out the form, saying that you are missing that information.

5. Submission of application forms ::

After filling out the information, point to the upper left corner of the "submit", online form can not be signed, you need to print the form, manual signature and then take pictures to upload.

After submitting, you will be taken to the "Pre-approval Processing Materials" section, which you can pass directly by clicking "Next":

6. Selection of processing modalities ::

If you are not in a hurry, you can choose "offline processing", if you are in a hurry, you can choose "video online processing" to try. I tried the video online check-in, but it kept showing that there was one person in the front line, so I couldn't use it.

7. Submission of applications for processing ::

Select offline processing and watch for public message notifications. I received a notification that the business was accepted on the second business day after submission, and if there are any problems the staff will explain in the message notification or may contact you by phone.

My first application was accepted by Bao'an District, but because I did not fill in the duplicate form related to the proposed entitlement agreement, I was directly rejected for processing. After revising and resubmitting the application, it was accepted by Futian District, and because of the missing explanatory material, the staff contacted me by phone and told me that the whole process might take longer because the Director's signature was needed at the end of the review, but the actual application was processed very quickly, in almost 3 working days.

As long as the material is accepted, there should be no problem, just wait patiently. Once the business has been accepted and completed, you can download the PDF file of "China Tax Resident Identification Card".

Other considerations

- The information filled in or provided by the applicant should be submitted in Chinese, and if the original of the relevant information is in a foreign language, a Chinese translation should be provided at the same time.

- The application form for the Certificate of China Tax Resident Status can be found athere areDownload.

- Generally speaking, the competent tax authorities shall finalize the matter within 10 working days from the date of accepting the application.

- Ensure that the documents submitted are clear, complete and up-to-date.

FAQ Frequently Asked Questions

1. How long is the China Tax Resident Identity Card valid? The China Tax Resident Identity Card is valid for one year and must be renewed annually.

2. What happens if I don't complete the tax information form? If local tax laws require tax to be withheld from payments made to you, Google may withhold tax from that payment at a higher rate.

3. If I don't update to the latest proof of tax residency, will I not be able to collect? No, you can still receive advertising money from Google without updating your China Tax Resident Identification Card.

4. What are the requirements for documentary proof of residence for tax purposes? A Tax Residency Certificate (TRC) is a government-issued document used to verify tax residency. If the TRC indicates that a country is associated with a tax treaty, the treaty must apply to that country. You may need to provide an English translation of your Tax Residency Certificate.

5. How do I determine my residence for tax purposes? A business or individual's country/territory of tax residence is where they are liable to pay tax. The country where you live is not necessarily your country of tax residence. To determine your tax status, consult a tax advisor or refer to your country's tax residency criteria.

6. Where can I apply for the China Tax Resident Identity Card? You can apply for the issuance of China Tax Resident Identity Card at the county-level tax authority in charge of your enterprise income tax. The Beijing Municipal Tax Bureau has listed the issuance of China Tax Resident Identity Card as a common matter in the city, so you can choose the nearest tax service hall to apply for issuance. In Shenzhen, you can apply for the China Tax Resident Identity Card online at Shenzhen Tax Service through the WeChat public number portal.

7. Can the application materials for the Certificate of Chinese Tax Resident Identity be submitted in English? The information filled in or provided by the applicant should be submitted in Chinese, and if the original of the relevant information is in a foreign language, a Chinese translation should be provided at the same time.

8. How long does it take to receive the China Tax Resident Identity Card after submitting the information? In general, the competent tax authorities shall finalize the matter within 10 working days from the date of acceptance of the application. If there are special circumstances such as inability to accurately determine the identity of a resident or the need to report to a higher tax authority, the matter shall be finalized within 20 working days.

9. Where can I download the application form for the China Tax Resident Identity Card? The application form for the Certificate of China Tax Resident Status can be found athere areDownload.

concluding remarks

In fact, I originally did not intend to update this proof of document, do not update it seems to have no impact on me, but see a lot of people are asking, to personally help you go through the process, to share some real experience to avoid everyone around the bend it. I hope this tutorial can help you successfully complete the Google AdSense tax proof of residence application, if you have to help you please click a praise and then go.

China Tax Resident Identity Certificate is an important document for enjoying the benefits of international tax agreements, especially for users who earn cross-border income through platforms such as Google AdSense, it is crucial to apply for and update the certificate in a timely manner. This article introduces the application process and precautions in detail, hoping to help you successfully complete the application and enjoy lower withholding tax rates and tax incentives.

appendice

AdSense Agreement Fact Sheet

尊敬的税务局工作人员:

您好!

根据贵局对税收居民身份证明申请材料的要求,我在此向贵局提供关于 Google AdSense 协议的情况说明。

由于 Google AdSense 作为全球广告平台,所提供的合作协议并非传统意义上的“常规合同”,因此在提交材料时,我们无法提供标准的、正式签署的合同文书。AdSense 平台的合作关系是基于 Google 在线服务协议建立的,用户与 Google 之间的合作通过同意并遵守 Google 的在线服务条款来完成,而并非通过传统的纸质合同。

因此,所提供的 Google AdSense 协议仅为该平台的在线协议版本,无法提供签署合同的物理文件。在此,我仅能提供协议的电子版本作为合作证明。

感谢贵局的理解与支持。如有任何进一步的问题,敬请随时联系。

此致

敬礼

申请人(签字):

日期:

Statement of habitual residence in Shenzhen due to household registration, family and economic interests

1. Provide both household registration and social security information:

尊敬的税务局工作人员:

您好!

根据贵局对税收居民身份证明申请材料的要求,我在此向贵局提供因户籍、家庭或经济利益关系而在深圳习惯性居住的情况说明。

1. 户籍情况:本人为深圳市常住户口,户籍所在地为深圳市。附件提供了我的户口本照片作为证明。

2. 社保证明:我在深圳长期工作,并在此缴纳社保。为此,附件提供了社保缴纳记录截图作为证明。

感谢贵局的理解与支持。如需进一步的材料或信息,请随时联系我。

此致

敬礼

申请人(签字):

日期:

2. Provide information on household registration only:

尊敬的税务局工作人员:

您好!

根据贵局对税收居民身份证明申请材料的要求,我在此向贵局提供因户籍、家庭或经济利益关系而在深圳习惯性居住的情况说明。

本人为深圳市常住户口,户籍所在地为深圳市。为证明我长期居住在深圳,特此提供我的户口本照片作为证明材料。

感谢贵局的理解与支持。如需进一步的材料或信息,请随时联系我。

此致

敬礼

申请人(签字):

日期:

3. Social security information only:

尊敬的税务局工作人员:

您好!

根据贵局对税收居民身份证明申请材料的要求,我在此向贵局提供因经济利益关系而在深圳习惯性居住的情况说明。

我在深圳长期工作,并在此缴纳社保。为了社会保障,我已在深圳按规定缴纳社保,并提供了相应的社保缴纳记录截图作为证明。

感谢贵局的理解与支持。如需进一步的材料或信息,请随时联系我。

此致

敬礼

申请人(签字):

日期:© Copyright notes

Article copyright AI Sharing Circle All, please do not reproduce without permission.

Related posts

No comments...