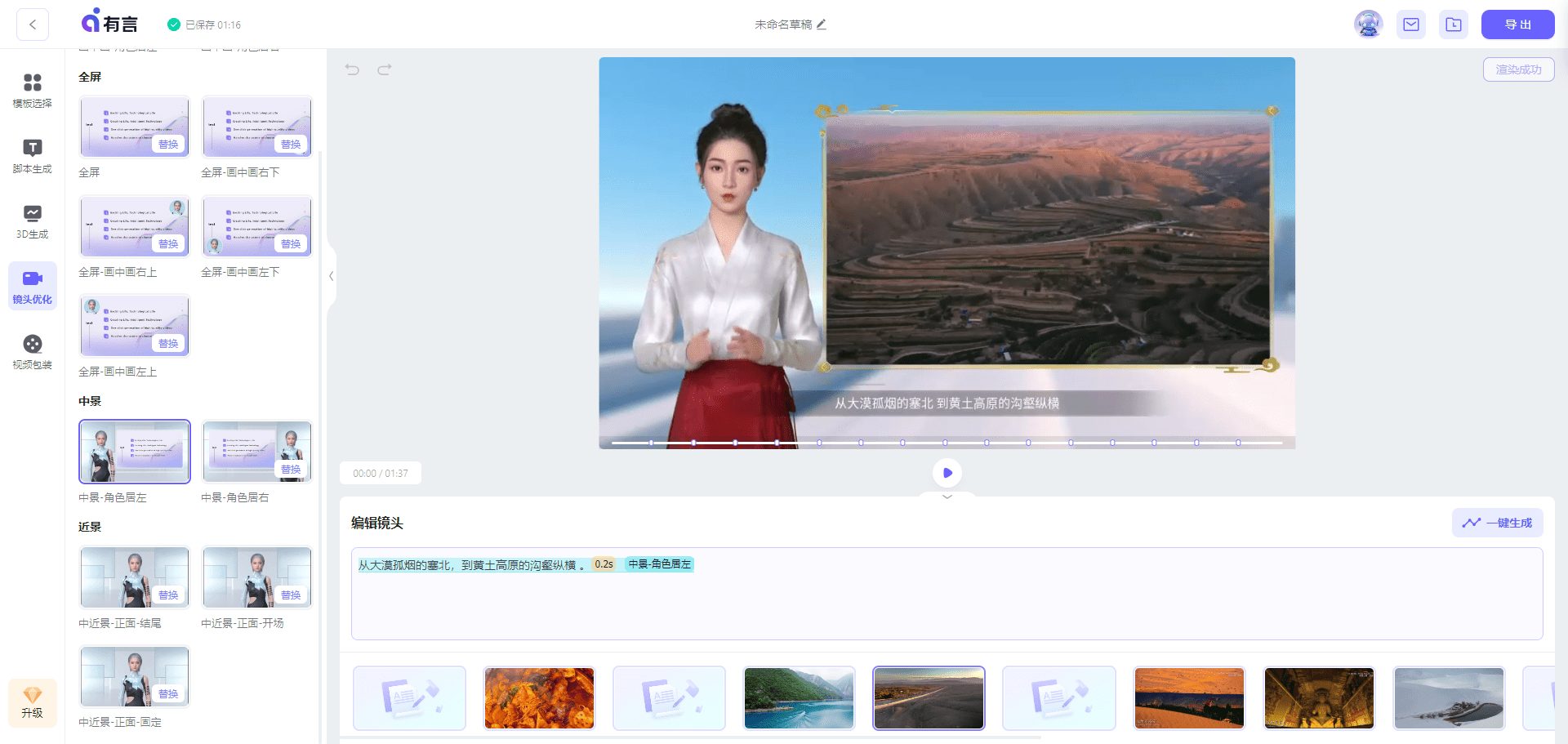

Sagehood AI: Using AI Analytics to Streamline Investment Decisions and Optimize Portfolios in the U.S. Equity Markets

General Introduction

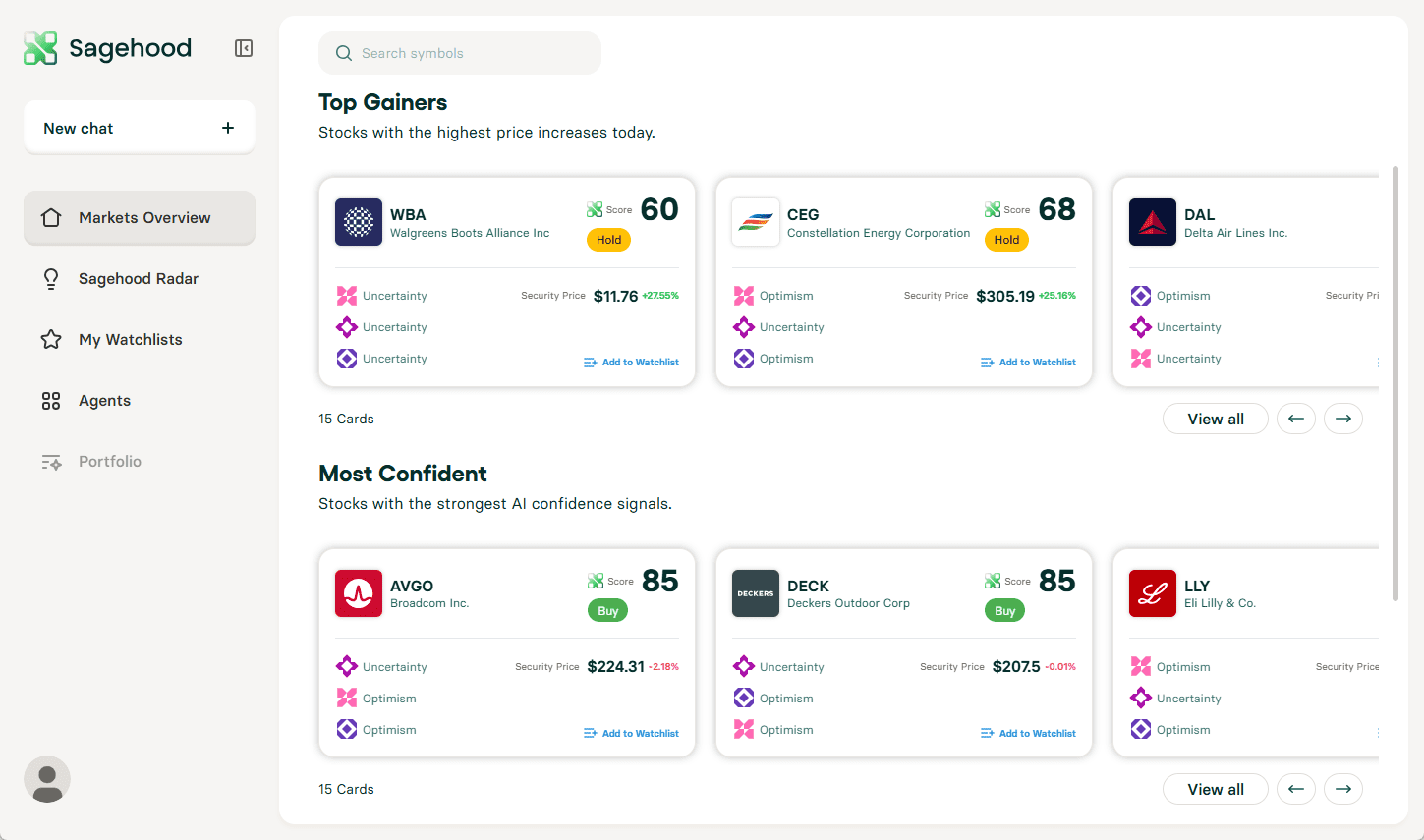

Sagehood AI is an AI-powered platform designed for investors to provide accurate stock market insights through multiple intelligent agents. The platform provides daily morning market forecasts, personalized stock picks, and comprehensive portfolio monitoring to help users make smarter decisions in the complex financial markets.Sagehood AI integrates multiple AI agents specializing in a variety of domains, from financial analytics and market trend forecasting to risk management and satellite imaging analytics, to support the investor's decision-making process on all fronts.

Function List

- Daily Morning Market Forecast:: Provides pre-opening market trend analysis and forecasts for the New York Stock Exchange.

- Personalized Stock Recommendations:: Provide customized stock recommendations based on the user's investment objectives and risk appetite.

- 360° Portfolio Monitoring:: Real-time portfolio tracking, providing updates and analysis of influencing factors.

- Chain effect detection: Analyze how global events affect specific industries and stocks.

- Market Sentiment Analysis:: Utilize social media and news sentiment analysis to predict short-term market movements.

- risk management:: Identify and manage risk factors in the portfolio and provide hedging strategies.

- Technical trading opportunities:: Identify technical analysis opportunities to optimize returns in volatile markets.

Using Help

Access platforms

First, users need to visit Sagehood AI's official website: landing.sagehood.ai. Register for a new account or log in with an existing account.

Setting Investment Preferences

- Once you have logged in, go to the "Investment Preferences" settings page.

- Fill in information about your personal investment objectives, risk tolerance, and investment horizon to ensure that you receive personalized advice. The system will adjust the recommended stocks and strategies based on these preferences.

Use of market forecasting functions

- Every morning, users receive an email with a market forecast for the day. This information can also be viewed in the "Daily Insights" section of the platform.

- The report includes general market trends, stocks or sectors of particular interest, and macroeconomic events that may affect the market.

Personalized Stock Recommendations

- Entering the "Stock Recommendation" module, AI will recommend a series of stocks according to the user's investment preferences.

- Each recommendation comes with a detailed analysis of the stock's current valuation, historical performance, and future growth potential. Click on each stock to view more in-depth analysis, such as financial statements, company news, and more.

Portfolio Monitoring

- In the "My Portfolio" section, users can add stocks or funds that they already hold.

- This displays the current value of each asset, the daily change, and a comparison to the market benchmark. The system also automatically flags risk factors or opportunities that need attention.

Chain effect detection

- Using this feature, users can enter or select a specific event (e.g., a policy change or natural disaster) and the platform will show how the event affects different industries or stocks through multiple segments.

- For example, type in "U.S.-China trade friction" and you'll see how it affects tech stocks, manufacturing, and more.

Market Sentiment and Technical Analysis

- The "Market Sentiment" tool allows users to see the prevailing sentiment on a particular stock or market to help determine when to buy or sell.

- The "Technical Analysis" tool provides graphical analysis of support, resistance and possible breakout points to help users find the best trading points in volatile markets.

Risk management and hedging

- In the Risk Management section, Sagehood AI analyzes the user's portfolio, points out potential risks, and suggests appropriate hedging strategies, such as buying options.

Application and optimization strategies

- Users can adjust their investment strategies based on the information provided by the platform. Each functional module has been designed with an intuitive user interface to ensure that it is easy to use even for users without a professional financial background.

By following these steps, users are able to fully utilize the capabilities of Sagehood AI to make more informed investment decisions that lead to better performance in the stock market.

© Copyright notes

Article copyright AI Sharing Circle All, please do not reproduce without permission.

Related posts

No comments...