Anthropic Prompts Engineering Course - Chapter 9 Exercise: Complex Prompts for Financial Services

typical example

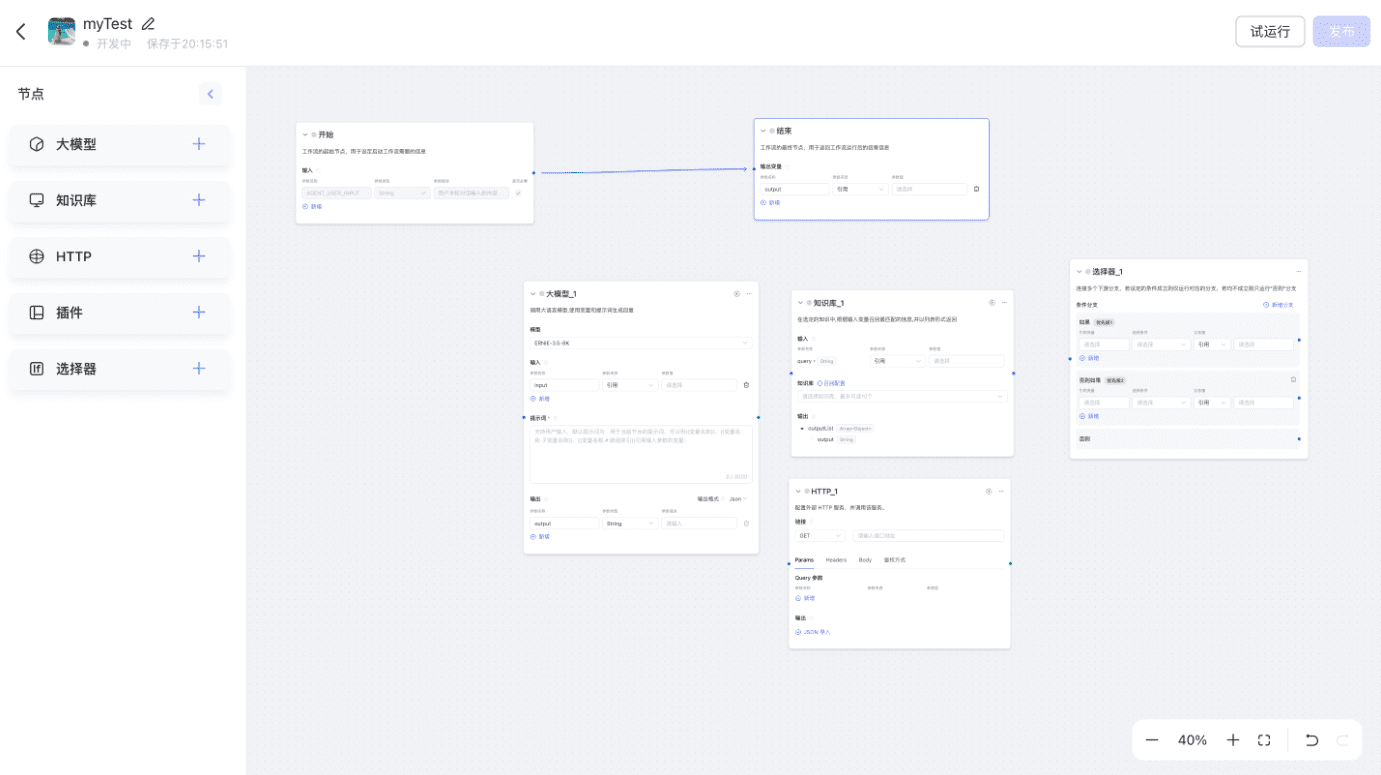

Prompts in the financial industry can also be quite complex for reasons similar to legal prompts. The following is an exercise in a financial usage scenario in which Claude were used to analyze tax information and answer questions. As with the legal services example, we have reordered some of the elements as our solution hints are more appropriate in a different process (however, other structures can be used as well).

We recommend that you scroll to the bottom of the page to see what expected inputs you need to consider (including what {{VARIABLE_WORDS}} is). Be sure to reference this {{VARIABLE_WORD}} directly somewhere in the prompt so that the actual variable content can be substituted in. Then, fill in each yellow box with the prompt element as described and as you saw in the previous three complex prompt examples. Once you've filled in all the yellow boxes, you'll see your final prompt splice result in the purple box at the bottom.

Keep in mind that cue word engineering is rarely completely formulaic, especially when targeting large and complex cues! It is important to develop test cases andExperiment with a variety of prompts and cue structures to figure out what works best for each situationThe

| cue element | descriptive | typical example | note |

|---|---|---|---|

| 1. "User:" format | Start your CLAUDEMESSAGES() prompt with "User:". | User. | This is required! It is always required to start with this when using the CLAUDEMESSAGES() prompt. |

| 2. Background to the mandate | Give Claude the context of the role it should play or the goals and tasks you want it to take on in the prompt. | You are a tax-savvy accountant. Your task is to answer user questions based on the references provided. | It's best to give context in the beginning of the prompt. |

| 3. Tonal context (optional) | If it is important in the interaction, tell Claude the tone of voice that should be used. | Depending on the task, this element may not be necessary. | |

| 4. Input data to be processed | If Claude needs to process data from the prompt, include that data within the relevant XML tags. Multiple data items can be included, but make sure that each data item is enclosed in its own XML tag. | "This is the material you should use to answer user questions: {{TAX_CODE}} " | When the input data is very long, it is best to provide it before the instruction. |

| 5. Examples | Give Claude at least one example of an ideal response so that it can be emulated. Enclose them in XML tags. If multiple examples are provided, give Claude context for what those examples are and enclose each example in its own XML tags. | "This is an example of how to answer: What defines an "eligible" employee? Under this subsection-- (A) General The term "eligible employee" means any individual who-- (i) is not an excluded employee, (ii) agrees, in accordance with an election under this subsection, to-- (A) meet the requirements established by the Secretary to ensure that the withholding requirements of the corporation under chapter 24 are satisfied. to meet such requirements as the Secretary determines are necessary to ensure that the withholding requirements of the Corporation under chapter 24 are satisfied. Based on the documentation provided, an "Eligible Employee" is defined as an Employee who: 1. is not an Excluded Employee as defined in the documentation; and 2. agrees to meet the requirements established by the Secretary. 2. agrees to meet the requirements established by the Secretary to ensure that the Corporation's withholding requirements for Qualified Stock under Chapter 24 are met. " | Examples are probably the most effective tool for getting Claude to behave as expected. Be sure to give examples of common edge cases. If prompted to use a sketchbook, it is also effective to give examples from the sketchbook. Usually more examples = more reliable responses, but with increased latency and token consumption. We only give one example here to make the prompt easier to read. |

| 6. Detailed mission descriptions and rules | Expand on the specific tasks you want Claude to perform and any rules Claude may need to follow. Here you can also give Claude the option to "quit" if it doesn't have an answer or doesn't know. | "First, collect relevant citations in tags to answer user questions. If there are no citations, write "No relevant citations found". Then insert two blank lines in the tag and answer the user question. Answer the user's question only if you are sure that the citation in the tag supports your answer. If not, tell the user that you unfortunately do not have enough information to answer the user's question." | It is ideal to show this description and rules to a friend to ensure that the logic is clear and any ambiguous terms are clearly explained. |

| 7. Description of immediate tasks | "Remind" Claude or just tell Claude what needs to be done immediately to accomplish the prompted task. This is also where you can put in additional variables such as user questions. | It's a user problem: {{QUESTION}} | It is usually not harmful to reiterate Claude's immediate task. It is best to place this at the end of a long prompt for better results. It is also usually good practice to place the user query at the bottom of the prompt. |

| 8. Prejudging (step-by-step thinking) (optional) | For tasks that have more than one step, it is a good idea to tell Claude to think step by step before giving the answer. Sometimes you may need to say "Before you give your answer ......" to make sure Claude does this step first. | Increases the intelligence of the response, but also increases the latency by increasing the length of the output. | |

| 9. Output format (optional) | If you want Claude's responses to be rendered in a particular format, please explicitly tell Claude what that format is. | Depending on the task, this element may not be necessary. | |

| 10. Pre-populated Claude's response (if any) | " a space that can be used to start a Claude response in order to direct Claude's behavior or response. If you want to pre-populate Claude's response, you must include "Assistant:" and it must be included as a new line, otherwise it will be treated as part of the "User:" round (which we'll handle for you automatically in this exercise! )." | You only need "Assistant:" if you want to pre-populate Claude's response. Otherwise, it can be omitted. |

Now let's link everything together, insert the replacement and see how it looks!

Tip: If you want to see the full cue box, you can set theyellow (color)of the Replace prompt box is copied and pasted into a text editor.

Tip template (linked from above)

用户:你是一位资深税务会计师。你的任务是使用任何提供的参考文档回答用户的问题。

以下是你应该用来回答用户问题的材料:

<docs>

{{TAX_CODE}}

</docs>

以下是如何回应的示例:

<example>

<question>

什么定义了“合格”员工?

</question>

<answer>

<quotes>根据本小节的目的——

(A) 一般而言

“合格员工”一词是指任何——

(i) 不是排除员工的个人,并且

(ii) 同意根据本小节所作的选择,遵守部长确定的为确保公司根据第 24 章对合格股票的预扣要求所需的规定。</quotes>

<answer>根据提供的文档,“合格员工”被定义为以下个人:

1. 根据文档定义,不是“排除员工”。

2. 同意遵守部长确定的规定,以确保公司在第 24 章下对合格股票的预扣要求得以满足。</answer>

</example>

首先,在 <quotes></quotes> 标签中收集与回答用户问题相关的引用。如果没有引用,写“未找到相关引用”。

然后在回答用户问题之前插入两个段落换行符,并在 <answer></answer> 标签中作答。仅当你确信 <quotes></quotes> 标签中的引用支持你的回答时,才回答用户问题。如果不确定,告诉用户你没有足够的信息来回答他们的问题。

以下是用户问题:{{QUESTION}}

variant

Input {{QUESTION}}

我有多长时间可以提交 83(b) 选举申请?

Input {{TAX_CODE}}

(a)一般规则

如果在与提供服务相关的情况下,财产转移给了除接受该服务的人员以外的任何人,那么该财产的公平市场价值(忽略除根据条款永远不会失效的限制之外的任何限制)在以下两种情况中较早发生时,应超过:

(1)受益人在该财产中的权益可转让或不再面临重大没收风险的第一次时间点的公平市场价值,超过

(2)为该财产支付的金额(如有),

应计入提供该服务的人的总收入中,在其首次转让权益或不再面临重大没收风险的应税年度中适用。 如果在该财产的权利变得可转让或不再面临重大没收风险之前,该人员以公允交易价出售或以其他方式处置了该财产,则前述句子不适用。

(b)选择在转让年度计入总收入

(1)概述

任何与服务提供相关的财产转移给其他人的人,可以选择将该财产在转让年度计入其应税年度的总收入,按以下方式计算超额部分:

(A)转让时该财产的公平市场价值(忽略除根据条款永远不会失效的限制之外的任何限制),超过

(B)为该财产支付的金额(如有)。

如果作出了这样的选择,(a)款将不适用于该财产的转让,并且如果该财产随后被没收,不得就该没收扣除任何金额。

(2)选择

根据(1)款作出的与任何财产转让有关的选择,应按照秘书规定的方式进行,并应在该转让之日起不超过30天内作出。 除非得到秘书的同意,否则该选择不可撤销。

(c)特殊规则

就本节而言——

(1)重大没收风险

如果一个人在财产中的权利取决于任何个人未来提供实质性服务,则该人对财产的权利面临重大没收风险。

(2)财产的可转让性

一个人在财产中的权利只有在该财产的任何受让人的权利不再面临重大没收风险时才是可转让的。

(3)根据《1934年证券交易法》第16(b)条可能引发诉讼的销售

只要出售财产获利可能导致某人根据《1934年证券交易法》第16(b)条受到诉讼,该人的财产权利则——

(A)面临重大没收风险,且

(B)不可转让。

(4)为了确定与服务提供相关的财产转让时个人的基础,应适用与第72(w)节规则相似的规则。

(d)永不失效的某些限制

(1)估值

在受永不失效的限制约束的财产的情况下,如果该限制仅允许受让人根据公式确定的价格出售该财产,则该价格应被视为该财产的公平市场价值,除非秘书证明相反,且举证责任应由秘书承担。

(2)取消

如果受永不失效的限制约束的财产,其限制被取消,则除非纳税人证明——

(A)该取消并非补偿性的,且

(B)如果该取消被视为补偿性交易,允许扣除的个人将以补偿性方式处理该交易,按秘书通过法规规定的方式提供证据,

该财产在取消时的公平市场价值(忽略限制)超过以下之和:

(C)取消前立即计算的该财产的公平市场价值(考虑到限制),和

(D)支付的取消金额(如有),

应视为发生取消的应税年度的补偿。

(e)本节的适用性

本节不适用于——

(1)第421条适用的交易,

(2)第401(a)条规定的信托的转让或符合第404(a)(2)条要求的年金计划下的转让,

(3)没有可明确的公平市场价值的期权的转让,

(4)在授予日期有可明确的公平市场价值的期权行使所导致的财产转让,或

(5)适用于第79条的团体人寿保险。

(f)持有期

在确定纳税人持有(a)款适用财产的期间时,应仅包括从其权利首次在该财产中可转让或不再面临重大没收风险时起算的期间。

(g)某些交换

如果适用(a)款的财产被交换为受与被交换财产类似的限制和条件约束的财产,并且第354条、第355条、第356条或第1036条(或与第1036条相关的第1031条)适用于该交换,或如果该交换是根据转换特权进行的——

(1)就(a)款而言,应忽略该交换,且

(2)收到的财产应视为(a)款适用的财产。

(h)雇主的扣除

如果本节适用的财产转让或(d)款规定的限制取消,应允许根据第162条扣除与转让该财产或取消限制相关的服务提供者计入其总收入的金额。该扣除应适用于服务提供者计入其总收入的应税年度或其结束的纳税年度。

(i)合格股权授予

(1)概述

就本法而言——

(A)计入的时间

如果合格股票转让给作出相关选择的合格员工,根据本款(a)款应在(B)项规定的应税年度而不是(a)款描述的应税年度中计入员工的收入。

(B)应纳税年度的确定

根据本款确定的应纳税年度为包含以下任一最早日期的员工应纳税年度:

(i)此类合格股票首次可转让的日期(仅为本项的目的,包括可转让给雇主的情况),

(ii)员工首次成为被排除员工的日期,

(iii)发行合格股票的公司的任何股票首次在已建立的证券市场上可以自由交易的日期(由部长确定,但不包括任何市场,除非该市场已被部长认定为适用于本小节以外的本标题中的某项规定的已建立证券市场),

(iv)员工的该股票在5年后的日期,此日期为该股票首次可转让或不再面临重大没收风险的日期,取较早者,或

(v)员工撤销(在部长规定的时间和方式下)对该股票依据本小节做出的选择的日期。

(2)合格股票

(A)概述

为本小节之目的,术语“合格股票”指与任何合格员工相关的公司股票,如果——

(i)该股票的获得——

(I)与行使期权有关,或

(II)与限制性股票单位的结算有关,且

(ii)该期权或限制性股票单位由公司授予——

(I)与作为员工提供服务有关,且

(II)在公司为合格公司的日历年度期间授予。

(B)限制

如果员工可以在其权利首次可转让或不再面临重大没收风险时将该股票出售给公司,或以现金代替股票的方式从公司获得现金,则该股票不属于“合格股票”。

(C)合格公司

为(A)(ii)(II)款之目的——

(i)概述

术语“合格公司”指在任何日历年度内,符合以下条件的公司:

(I)在任何之前的日历年度内,该公司的任何股票(或其前身的股票)未在已建立的证券市场上自由交易(根据(1)(B)(iii)款的规定),且

(II)公司有书面计划,在该日历年度内,至少80%的在美国境内(或美国领地)为公司提供服务的所有员工获得期权或限制性股票单位,并享有相同的权利和特权以获得合格股票。

(ii)相同的权利和特权

为(i)(II)款之目的——

(I)除(II)和(III)款另有规定外,股票的权利和特权的确定应类似于第423(b)(5)节下的规定,

(II)如果所有员工可获得的股份数量不相等,员工不应仅因此而被视为未享有相同的权利和特权,只要每位员工可获得的股份数量超过最低数量,且

(III)行使期权的权利和特权不应视为与限制性股票单位的结算权利和特权相同。

(iii)员工

为(i)(II)款之目的,术语“员工”不包括第4980E(d)(4)节或任何被排除的员工所描述的员工。

(iv)2018年之前日历年度的特殊规则

对于2018年1月1日之前的任何日历年度,在适用(i)(II)款时,不考虑合格股票的权利和特权是否相同。

(3)合格员工;被排除员工

为本小节之目的——

(A)概述

术语“合格员工”指任何符合以下条件的个人:

(i)不是被排除的员工,且

(ii)在根据本小节做出的选择中同意遵守由部长确定的确保公司在第24章下的合格股票扣缴要求的必要条件。

(B)被排除员工

术语“被排除员工”指与任何公司相关的任何个人——

(i)在日历年度的任何时间内,或在之前10个日历年度内的任何时间,属于1%所有者(依据第416(i)(1)(B)(ii)节的定义),

(ii)现在或过去的任何时候——

(I)是该公司的首席执行官或担任此职位的个人,或

(II)是该公司的首席财务官或担任此职位的个人,

(iii)与(ii)(I)或(II)款中描述的任何个人有第318(a)(1)节中所述的关系,或

(iv)是该公司应纳税年度的4名最高薪酬管理人员之一,或在之前10个应纳税年度中的任何一个应纳税年度内是该公司4名最高薪酬管理人员之一,依据1934年《证券交易法》的股东薪酬披露规则(假定这些规则适用于该公司)。

(4)选择

(A)选择的时间

合格股票的选择应在员工的权利首次可转让或不再面临重大没收风险后的30天内进行,以较早者为准,且选择方式应类似于(b)小节下的选择方式。

(B) 限制

如果符合以下条件,则不得根据本节就任何合格股票作出选择——

(i) 合格员工已就该合格股票根据(b)小节作出了选择,

(ii) 在选择作出之前,发行合格股票的公司的任何股票在已建立的证券市场上可自由交易(根据(1)(B)(iii)段的规定),或

(iii) 该公司在包括员工权益可转让或不再受重大没收风险约束的日历年之前的日历年购买了其任何未清偿股票,除非——

(I) 该公司购买的股票中不低于25%的总金额为递延股票,且

(II) 以合理的方式确定从哪些个人手中购买递延股票。

(C) 与股票赎回限制相关的定义和特殊规则

(i) 递延股票

在本段中,“递延股票”指根据本小节有效选择的股票。

(ii) 如果个人持有递延期限较长的递延股票,则不计入与该个人有关的递延股票

公司从任何个人手中购买的股票不得被视为用于(B)(iii)小段目的的递延股票,若该个人(在购买后立即)持有的任何递延股票的选择期限长于所购买股票的选择期限。

(iii) 购买所有未清偿递延股票

如果所购买的股票包括该公司所有的未清偿递延股票,则应视为满足(B)(iii)小段中的(I)和(II)要求。

(iv) 报告

任何在年初拥有未清偿递延股票并且在该日历年购买了任何未清偿股票的公司,应在其应税年度结束或该日历年结束时的纳税申报表中列出其在该日历年内购买的未清偿股票的总金额,以及国务卿为执行本段所要求的其他信息。

(5) 受控集团

就本小节而言,所有根据第414(b)条视为单一雇主的人员应视为一个公司。

(6) 通知要求

任何公司在向合格员工转让合格股票时,应在该股票产生的金额首次可计入该员工的总收入时(如果没有本小节)或在此之前的合理期间内——

(A) 向该员工证明该股票为合格股票,并且

(B) 通知该员工——

(i) 该员工可能有资格选择根据本小节递延该股票的收入,且

(ii) 如果员工作出此选择——

(I) 在递延期结束时确认的收入金额将基于该员工对该股票的权益首次可转让或不再受重大没收风险约束时的股票价值,无论在递延期内股票价值是否下跌,

(II) 在递延期结束时确认的收入金额将按照第3401(i)条规定的税率根据第3402(t)条的规定进行预扣,且

(III) 该员工就此预扣的责任(由国务卿根据(3)(A)(ii)段确定)。

(7) 限制性股票单位

本节(除本小节外),包括(b)小节下的任何选择,不适用于限制性股票单位。

Splicing tips with replacement

用户:你是一名资深税务会计师。你的任务是使用任何提供的参考文档来回答用户的问题。

以下是你应该用来回答用户问题的材料:

<docs>

(a)一般规则

如果在服务履行过程中,财产转移给任何其他人,而非为其执行该服务的人,则以下金额的超额部分应计入提供该服务的人的总收入:

(1) 在该财产首次转让给具有该财产受益权的人的权利可转让或不再受重大没收风险约束时(以先发生者为准),该财产的公平市场价值(不考虑任何限制,除非该限制根据其条款永远不会消失);减去

(2) 支付的金额(如果有的话)。

超额部分应计入该服务提供者在首次该财产权利可转让或不再受重大没收风险约束的纳税年度的总收入中。前一句不适用于该人在其权利可转让或不再受重大没收风险之前,以公允交易的方式出售或以其他方式处理该财产的情况。

(b)选择在转让年度计入总收入

(1)一般规则

任何与财产转移有关的服务提供者可以选择在该财产转移的纳税年度将以下金额的超额部分计入其总收入:

(A)转让时该财产的公平市场价值(不考虑任何限制,除非该限制根据其条款永远不会消失);减去

(B)支付的金额(如果有的话)。

如果选择了此选项,则第 (a) 款不适用于该财产的转让,如果该财产随后被没收,则不得就该没收扣除任何金额。

(2)选择

与任何财产转让有关的选择应按照财政部长规定的方式进行,并应在该财产转让日期后 30 天内进行。除非获得财政部长的同意,否则该选择不得撤销。

(c)特别规则

为本节目的目的:

(1)重大没收风险

如果一个人对财产的享有权利需取决于该人未来提供重大服务,则该人对财产的权利受重大没收风险约束。

(2)财产的可转让性

一个人对财产的权利只有在受让人对该财产的权利不受实质性没收风险影响时才能转让。

(3)《1934 年证券交易法》第 16(b) 条可能引起诉讼的销售

只要以盈利方式出售财产可能使某人根据《1934 年证券交易法》第 16(b) 条受到诉讼,那么该人对该财产的权利将——

(A)受到实质性没收风险的影响,且

(B)不可转让。

(4)为确定与服务绩效相关的财产转让中个人的财产基础,适用与第 72(w) 条类似的规则。

(d)永远不会失效的某些限制

(1)估值

对于按其条款永远不会失效的限制所约束的财产,且该限制仅允许受让人按照公式确定的价格出售该财产,则该确定的价格应视为该财产的公平市场价值,除非由部长提出相反的证明,且举证责任由部长承担。

(2)取消

如果某项永远不会失效的限制被取消,除非纳税人证明——

(A)该取消不是补偿性的,且

(B)如果该取消被视为补偿性的,任何有资格获得扣除的人都将按照部长通过法规规定的方式将该交易视为非补偿性,

则在取消时,该财产的公平市场价值(不考虑限制的情况下计算)超过以下两项之和的部分——

(C)取消前立即按考虑限制的情况下计算的该财产的公平市场价值,及

(D)为取消支付的金额(如果有的话),

应视为取消发生的纳税年度的补偿收入。

(e)本条适用范围

本条不适用于——

(1)适用第 421 条的交易,

(2)转移至或来自第 401(a) 条所述信托,或符合第 404(a)(2) 条要求的年金计划下的转移,

(3)转移没有可合理确定的公平市场价值的期权,

(4)在授予日拥有可合理确定的公平市场价值的期权行使时转移财产,或

(5)适用第 79 条的团体定期寿险。

(f)持有期

在确定纳税人持有适用本条第 (a) 款的财产的期间时,应仅包括该人在其对该财产的权利可转让或不受实质性没收风险影响的最早时间开始的期间。

(g)某些交换

如果适用本条第 (a) 款的财产被交换为受与交换财产类似的限制和条件影响的财产,且该交换适用第 354、355、356 或 1036 条(或第 1031 条与第 1036 条相关的部分),或该交换是根据转换权利行使的,则——

(1)该交换在适用第 (a) 款时应被忽略,且

(2)接收的财产应被视为适用第 (a) 款的财产。

(h)雇主扣除

如果本条适用于财产转移或第 (d) 款所述限制的取消,则应根据第 162 条,允许为该人服务的雇主扣除一笔等于根据第 (a)、(b) 或 (d)(2) 款计入提供该服务者的总收入的金额的扣除额。该扣除应适用于该人的应税年度或与该应税年度相终结的年度内计入提供该服务者总收入的金额。

(i)合格的股权授予

(1)一般规则

就本小标题而言——

(A)包含时间

如果合格股票被转让给选择根据本小节就该股票作出选择的合格雇员,则应通过将根据本小节确定的与该股票相关的金额包括在雇员的应税年度内来应用小节 (a) ,该应税年度按照 (B) 小段确定,而不是小节 (a) 中描述的应税年度。

(B)应税年度的确定

根据本小段确定的应税年度是指包括以下最早日期的雇员的应税年度——

(i)该合格股票首次可以转让的日期 (包括仅为本项之目的变得可转让给雇主的情况),

(ii)雇员首次成为被排除雇员的日期,

(iii)发行合格股票的公司任何股票首次可以在已建立的证券市场上自由交易的日期 (由部长确定,但不包括除非部长根据本小节以外的本标题条款将其承认为已建立的证券市场的任何市场),

(iv)自雇员对该股票的权利首次可以转让或不再受实质性丧失风险约束之日起的 5 年日期,以较早者为准,或

(v)雇员撤销根据本小节就该股票作出的选择的日期 (按照部长规定的时间和方式)。

(2)合格股票

(A)一般规则

就本小节而言,术语“合格股票”是指与任何合格雇员相关的公司股票,如果——

(i)该股票是通过以下方式获得的——

(I)与期权的行使相关,或

(II)与受限股票单位的结算相关,且

(ii)该期权或受限股票单位是由公司在以下时间授予的——

(I)与作为雇员提供服务相关,且

(II)在该公司是合格公司的日历年度内。

(B)限制

如果在雇员对该股票的权利首次可以转让或不再受实质性丧失风险约束之时,雇员可以将该股票出售给公司或以现金替代股票,则该股票不得视为合格股票。

(C) 合格公司

就子段 (A)(ii)(II) 的目的而言—

(i) 一般规定

“合格公司”是指,在任何日历年度内,任何公司如果—

(I) 在任何前一个日历年度内,该公司(或该公司的任何前身)的股票不在已建立的证券市场上可以方便地交易(根据段落 (1)(B)(iii) 确定),以及

(II) 该公司有一个书面计划,根据该计划,在该日历年度内,不少于 80% 的所有在美国(或美国的任何属地)为该公司提供服务的员工被授予股票期权,或被授予受限股票单位,并享有相同的获得合格股票的权利和特权。

(ii) 相同的权利和特权

就子条款 (i)(II) 的目的而言—

(I) 除非子条款 (II) 和 (III) 有不同规定,股票的权利和特权的确定应以类似于第 423(b)(5) 节的方式进行,

(II) 员工不应因为所有员工可获得的股票数量不相等而被视为没有相同的权利和特权,只要每位员工获得的股票数量超过微不足道的数量,

(III) 关于期权行使的权利和特权不应被视为与受限股票单位结算的权利和特权相同。

(iii) 员工

就子条款 (i)(II) 的目的而言,“员工”一词不包括第 4980E(d)(4) 节所描述的任何员工或任何被排除的员工。

(iv) 2018 年前的日历年度特别规则

对于 2018 年 1 月 1 日之前开始的任何日历年度,子条款 (i)(II) 的应用不考虑有关合格股票的权利和特权是否相同。

(3) 合格员工;被排除员工

就本小节而言—

(A) 一般规定

“合格员工”是指任何—

(i) 不是被排除员工的人,和

(ii) 在根据本小节做出的选举中,同意满足秘书认为必要的要求,以确保公司根据第 24 章的预扣要求得到满足。

(B) 被排除员工

“被排除员工”是指,与任何公司相关的任何个人—

(i) 在任何日历年度期间是 1% 的所有者(根据第 416(i)(1)(B)(ii) 节的定义),或在前 10 个日历年度的任何时间是这样的 1% 所有者,

(ii) 在任何以前的时间是或曾是—

(I) 该公司的首席执行官或担任此职务的个人,或

(II) 该公司的首席财务官或担任此职务的个人,

(iii) 与子条款 (ii) 的 (I) 或 (II) 描述的任何个人存在第 318(a)(1) 节所描述的关系,或

(iv) 在应税年度内是该公司薪酬最高的 4 名高管之一,或在前 10 个应税年度的任何时间是该公司薪酬最高的 4 名高管之一,按照证券交易法 1934 年的股东披露规则(如这些规则适用于该公司)来确定每个应税年度。

(4) 选举

(A) 做出选举的时间

关于合格股票的选举应在员工对该股票的权利可转让或不再面临重大失效风险的首个日期后的 30 天内做出,以较早者为准,并应以类似于第 (b) 节中选举的方式进行。

(B) 限制

在本节下,不能对任何合格股票做出选择,如果—

(i) 合格员工已经根据第 (b) 款对该合格股票做出了选择,

(ii) 在做出选择之前,发行该合格股票的公司任何股票在一个建立的证券市场上可被容易交易(如第 (1)(B)(iii) 款所规定),或

(iii) 该公司在日历年之前的日历年中购买了任何未偿还的股票,除非—

(I) 购买的股票中不少于 25% 的总金额是递延股票,并

(II) 从哪些个人处购买递延股票的决定是基于合理的基础。

(C) 限制股票赎回的定义和特别规则

(i) 递延股票

就本段而言,“递延股票”是指在本小节下有效的选择所涉及的股票。

(ii) 如果个人持有递延期较长的递延股票,则该个人的递延股票不予考虑

如果个人(在此购买后立即)持有任何递延股票,而这些递延股票的选择有效期比购买的股票选择的有效期更长,则由公司从该个人处购买的股票不会被视为递延股票,供第 (B)(iii) 款使用。

(iii) 购买所有未偿还的递延股票

如果购买的股票包括公司所有的未偿还递延股票,则第 (B)(iii) 款的第 (I) 和 (II) 条件视为满足。

(iv) 报告

任何在任何日历年开始时拥有未偿还递延股票的公司,在该日历年期间购买了任何未偿还股票的,应在该日历年结束的税务年度的税务申报表中包括该年度购买的未偿还股票的总金额及财政部秘书所要求的其他信息,用于本段的管理。

(5) 控制集团

为了本小节的目的,所有在第 414(b) 节下被视为单一雇主的人应被视为一个公司。

(6) 通知要求

任何将合格股票转让给合格员工的公司应在—

(A) 该股票的金额将(但不受本小节影响)首次包含在该员工的总收入中的时候(或在此之前的合理期限内),

(B) 向该员工证明该股票是合格股票,并通知该员工—

(i) 员工可能有资格根据本小节选择递延该股票上的收入,并

(ii) 如果员工做出该选择—

(I) 递延期结束时确认的收入金额将基于股票在员工的权利首次可转让或不再面临实质性风险的时点的价值,而不管在递延期内股票的价值是否有所下降,

(II) 递延期结束时确认的收入金额将根据第 3401(i) 节的税率进行预扣,税率由第 3402(t) 节确定,并

(III) 员工的责任(由财政部秘书根据第 (3)(A)(ii) 款确定)与此预扣相关。

(7) 限制性股票单位

本节(不包括本小节),包括根据第 (b) 款的任何选择,不适用于限制性股票单位。

</docs>

以下是如何回应的示例:

<example>

<question>

什么定义了一个“合格”的员工?

</question>

<answer>

<quotes>就本小节而言—

(A) 一般规定

“合格员工”是指任何—

(i) 不属于排除员工的个人,以及

(ii) 在本小节规定的选举中同意满足秘书确定的、确保公司根据第 24 章对合格股票的扣缴要求得到满足的要求。</quotes>

<answer>根据提供的文档,“合格员工”定义为:

1. 不属于文档中定义的“排除员工”。

2. 同意满足秘书确定的要求,以确保公司根据第 24 章对合格股票的扣缴要求得到满足。</answer>

</example>

首先,收集在 <quotes></quotes> 标签中的与回答用户问题相关的引用。如果没有相关引用,请写“未找到相关引用”。

然后在回答用户问题时,在 <answer></answer> 标签中插入两个段落换行。仅在您确信 <quotes></quotes> 标签中的引用支持您的回答时才回答用户问题。如果不确定,请告知用户您没有足够的信息来回答其问题。

用户的问题是:我需要多长时间才能做出 83b 选举?

Claude's answer

<quotes>根据第(1)段关于任何财产转移的规定,选举应按照秘书规定的方式进行,并且应在转移日期后的 30 天内完成。除非得到秘书的同意,否则该选举不能被撤销。</quotes>

<answer>根据文档,您有 30 天的时间在财产转移日期后进行 83(b) 选举。除非获得秘书的同意,否则该选举不能被撤销。</answer>© Copyright notes

Article copyright AI Sharing Circle All, please do not reproduce without permission.

Related articles

No comments...