Agentar-Fin-R1 - A Grand Model for Reasoning in Finance by Anthem Digital

What is Agentar-Fin-R1?

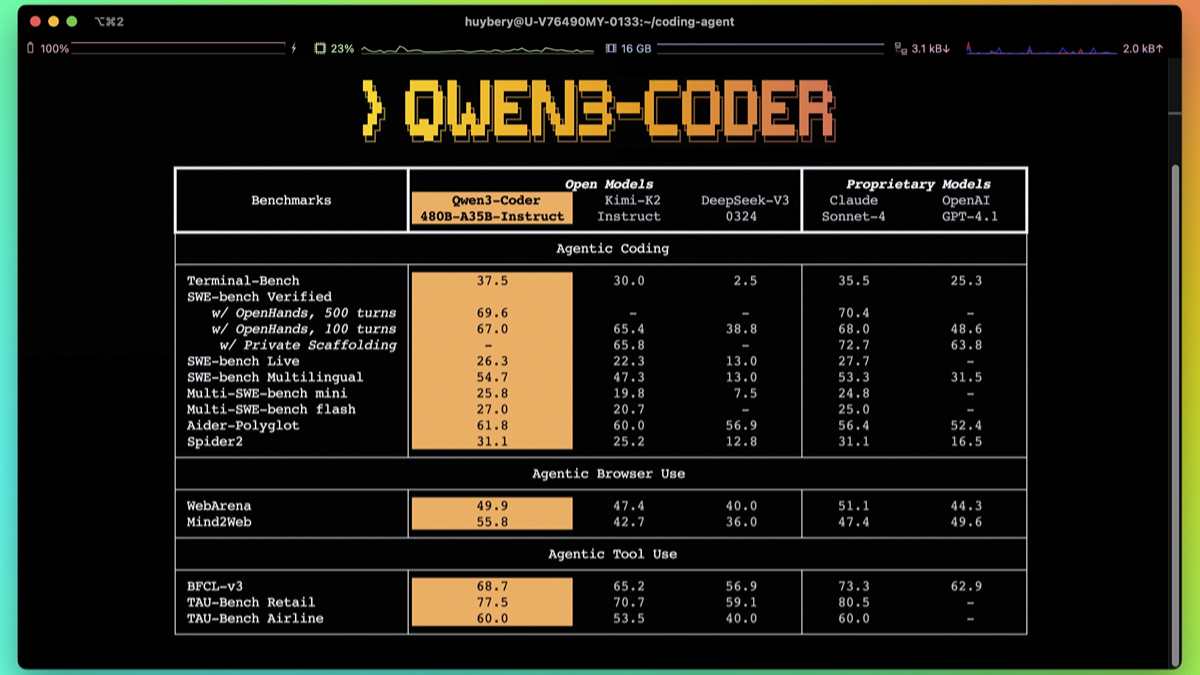

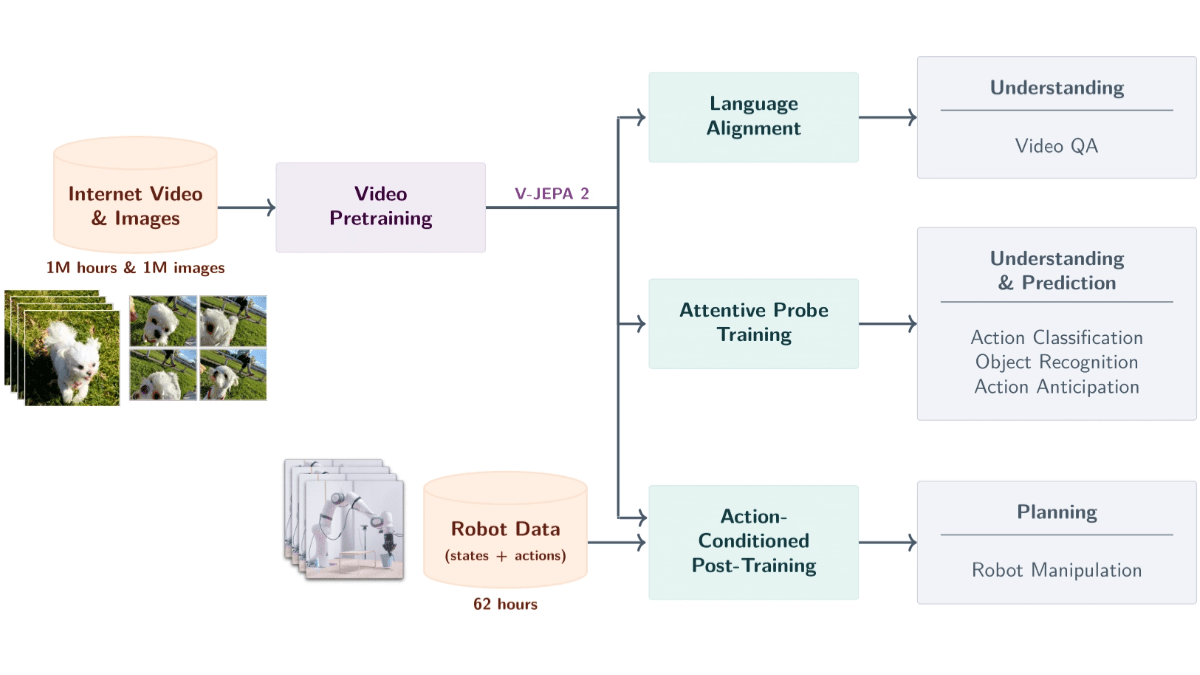

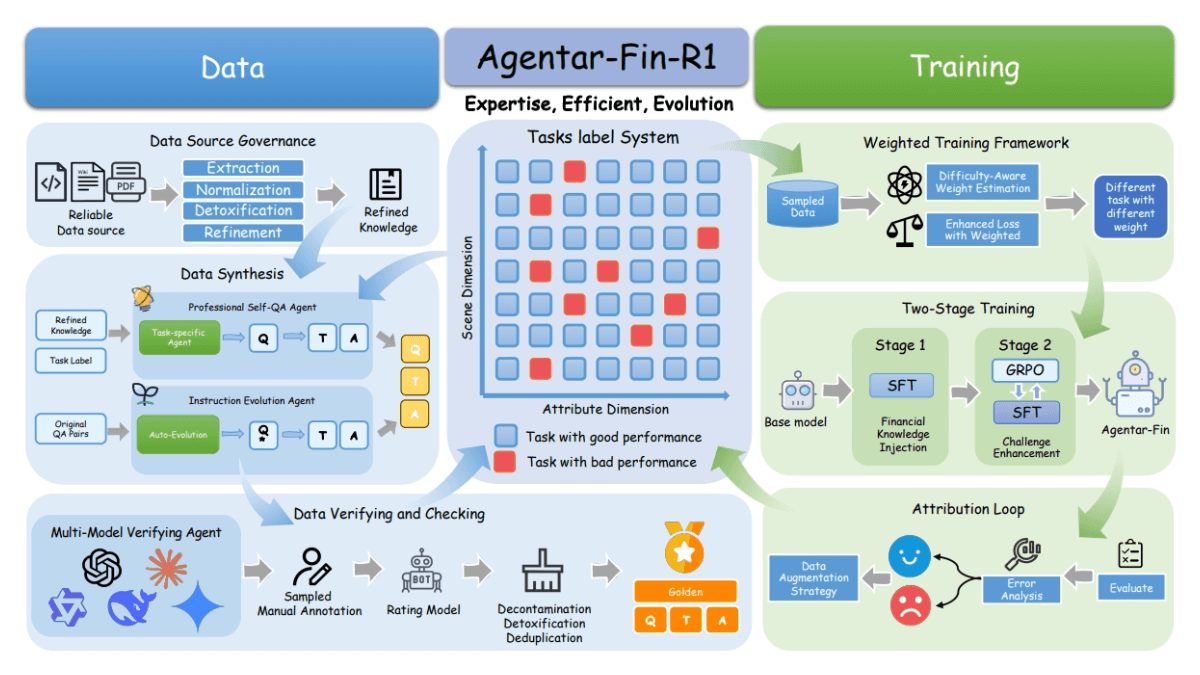

Agentar-Fin-R1 is a state-of-the-art large language model for the financial domain launched by Anthem. Developed based on the powerful Qwen3 architecture, the model provides two parameter scale versions, 8B and 32B, and can accurately handle complex financial reasoning tasks, including multi-step analysis, risk assessment and strategic planning. The model is optimized based on a fine-grained financial task labeling system and a multi-dimensional trustworthiness assurance framework to ensure the trustworthiness of data sources, synthesis and governance. The model demonstrates excellent performance in both financial benchmarking and general reasoning tasks, and supports a variety of application scenarios such as financial intelligent customer service, risk assessment, market analysis, financial statement parsing, and personalized recommendation, while strictly adhering to compliance requirements to provide financial institutions with efficient, secure, and reliable decision support.

Main functions of Agentar-Fin-R1

- Complex financial task processing: Can handle complex financial tasks such as multi-step analysis, risk assessment and strategic planning, providing deep reasoning support to financial institutions.

- Precision Decision Aid: Provide financial institutions with accurate decision-making advice to help make informed choices in complex and volatile financial markets.

- Precise recognition of user intent: Provide personalized services by accurately understanding users' needs in financial scenarios, such as investment advice and product inquiries.

- Key information extraction: Accurately identifying and structuring key information from financial texts, such as fund names, stock codes, etc., to provide a data base for subsequent analysis.

- Financial Instrument Recommendations: Recommend appropriate financial tools based on user needs, such as portfolio analysis tools, to enhance user experience and work efficiency.

- Professional expression generation: Generate professional financial expressions that meet regulatory requirements and ensure information transparency and compliance.

- Security and risk prevention: Identify security threats such as malicious input and data leakage to ensure stable operation of the financial system.

Agentar-Fin-R1's official website address

- arXiv Technical Paper:: https://arxiv.org/pdf/2507.16802

Agentar-Fin-R1's Core Benefits

- Professional optimization in the financial sector: Agentar-Fin-R1 is based on a refined financial task labeling system and multi-dimensional trustworthiness guarantee, which accurately covers financial scenarios and ensures high data quality.

- Strong reasoning and decision-making skills: The model is equipped with complex reasoning capability, combined with dynamic weighted training and two-stage training strategy to effectively improve the accuracy of financial decision support.

- Efficient data processing and validation: A dual-track data synthesis strategy and multi-model consistency validation are used to ensure the high quality and reliability of the data, providing a solid foundation for model training.

- Security and Compliance Assurance: Agentar-Fin-R1 identifies security risks and adheres to strict compliance requirements to ensure the stable and legal operation of the financial system.

- Innovative assessment benchmarks: The Finova evaluation benchmark comprehensively measures the performance of models in financial scenarios in three dimensions: intelligent body capability, complex reasoning capability and security compliance.

- Wide range of application scenarios: It supports a variety of applications such as financial intelligent customer service, risk assessment, market trend analysis, financial statement analysis and personalized recommendation to meet the diversified needs of financial institutions.

Individuals for whom Agentar-Fin-R1 is indicated

- Financial institution professionals: Including analysts, risk assessors, customer service personnel of banks, securities, insurance and other financial institutions, etc., with the help of the model to improve work efficiency and decision-making quality.

- financial technology company: Technology companies developing finance-related applications and services that integrate Agentar-Fin-R1 to enhance product functionality, such as intelligent customer service and risk management systems.

- Financial industry researchers: Scholars and researchers working in the field of finance, using models for market trend analysis, financial model validation, and other research work.

- financial regulator: Government departments and agencies responsible for financial regulation to assist with compliance checks and risk monitoring.

- Financial Product Developer: Teams designing and developing financial products can use models for product planning, market analysis and customer demand forecasting.

© Copyright notes

Article copyright AI Sharing Circle All, please do not reproduce without permission.

Related posts

No comments...