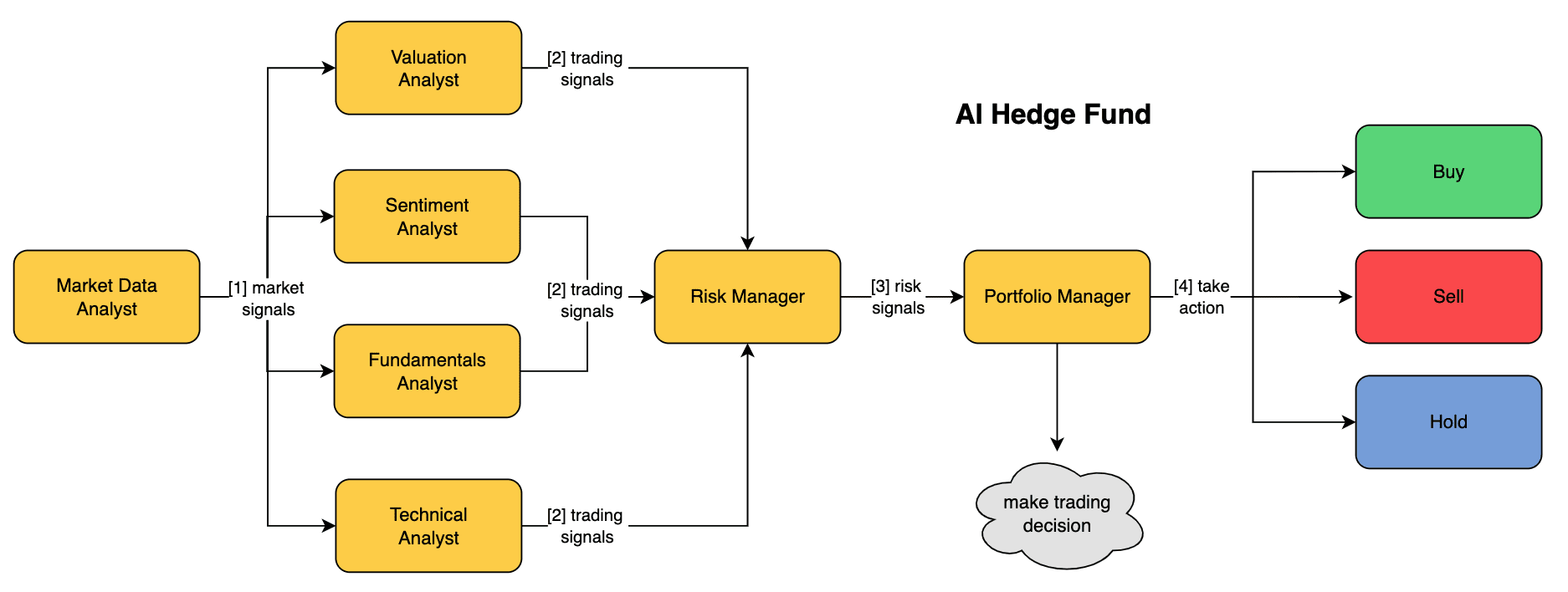

AI investment system: automated A-share investment decision-making system that utilizes a multi-intelligence system to analyze market data

General Introduction

A_Share_investment_Agent is an A-share investment decision aid based on a multi-intelligence system. The system is designed to generate trading signals by using multiple collaborative intelligences to analyze market data, calculate the intrinsic value of stocks, and analyze market sentiment as well as fundamental data. This approach helps investors better understand market dynamics and make more informed investment decisions. The program is for educational purposes only and is not intended for actual trading or investing.

Function List

- Market data analysis: collection and pre-processing of market data

- Valuation Agents: Calculate the intrinsic value of a stock and generate trading signals

- Sentiment Brokerage: Analyzing Market Sentiment and Generating Trading Signals

- Fundamental Agents: Analyze fundamental data and generate trading signals

- Comprehensive Trading Signal Generation: Integrate signals generated by various intelligences to provide comprehensive trading recommendations

Using Help

Installation process

- Clone the project code:

git clone https://github.com/24mlight/A_Share_investment_Agent.git cd A_Share_investment_Agent

2. 安装依赖:

```bash

pip install -r requirements.txt

- Configure environment variables:

Based on the project's.env.examplefile creates a.envfile and fill in the appropriate configuration entries.

Functional operation flow

Market Data Analysis

The Market Data Analysis module is responsible for collecting and pre-processing market data. By calling the data source API, the latest market data is regularly obtained and preprocessed for subsequent use by the intelligences.

Valuation Agent

The Valuation Agent module is responsible for calculating the intrinsic value of a stock based on market data. The module uses various valuation models, such as discounted cash flow models, relative valuation models, etc., to generate an estimate of the intrinsic value of each stock.

emotional agent

The Sentiment Proxy module generates market sentiment signals by analyzing market sentiment data from news, social media, and other channels. The module uses natural language processing techniques to extract the sentiment tendencies in the text and convert them into quantitative signals.

Fundamental Agents

The Fundamental Proxy module generates fundamental signals by analyzing a company's financial statements, operating data, and other fundamental information. The module uses financial ratio analysis, trend analysis, and other methods to assess a company's fundamental position.

Integrated trading signal generation

The integrated trading signal generation module integrates the signals generated by the various intelligences to provide integrated trading recommendations. The signals from the various intelligences are fused to generate the final trading recommendations through methods such as weighted averaging and voting mechanisms.

usage example

Below is a usage example showing how to run the entire system and get trade recommendations:

from agents import MarketDataAnalyst, ValuationAgent, SentimentAgent, FundamentalsAgent, TradeSignalGenerator

# 初始化各智能体

market_data_analyst = MarketDataAnalyst()

valuation_agent = ValuationAgent()

sentiment_agent = SentimentAgent()

fundamentals_agent = FundamentalsAgent()

trade_signal_generator = TradeSignalGenerator()

# 获取市场数据

market_data = market_data_analyst.get_market_data()

# 生成各智能体的信号

valuation_signal = valuation_agent.generate_signal(market_data)

sentiment_signal = sentiment_agent.generate_signal(market_data)

fundamentals_signal = fundamentals_agent.generate_signal(market_data)

# 综合交易信号

final_trade_signal = trade_signal_generator.generate_signal([valuation_signal, sentiment_signal, fundamentals_signal])

print(f"综合交易信号:{final_trade_signal}")© Copyright notes

Article copyright AI Sharing Circle All, please do not reproduce without permission.

Related posts

No comments...